Замовити кошторис на будівнитво – 5 причин, навіщо це потрібно зробити

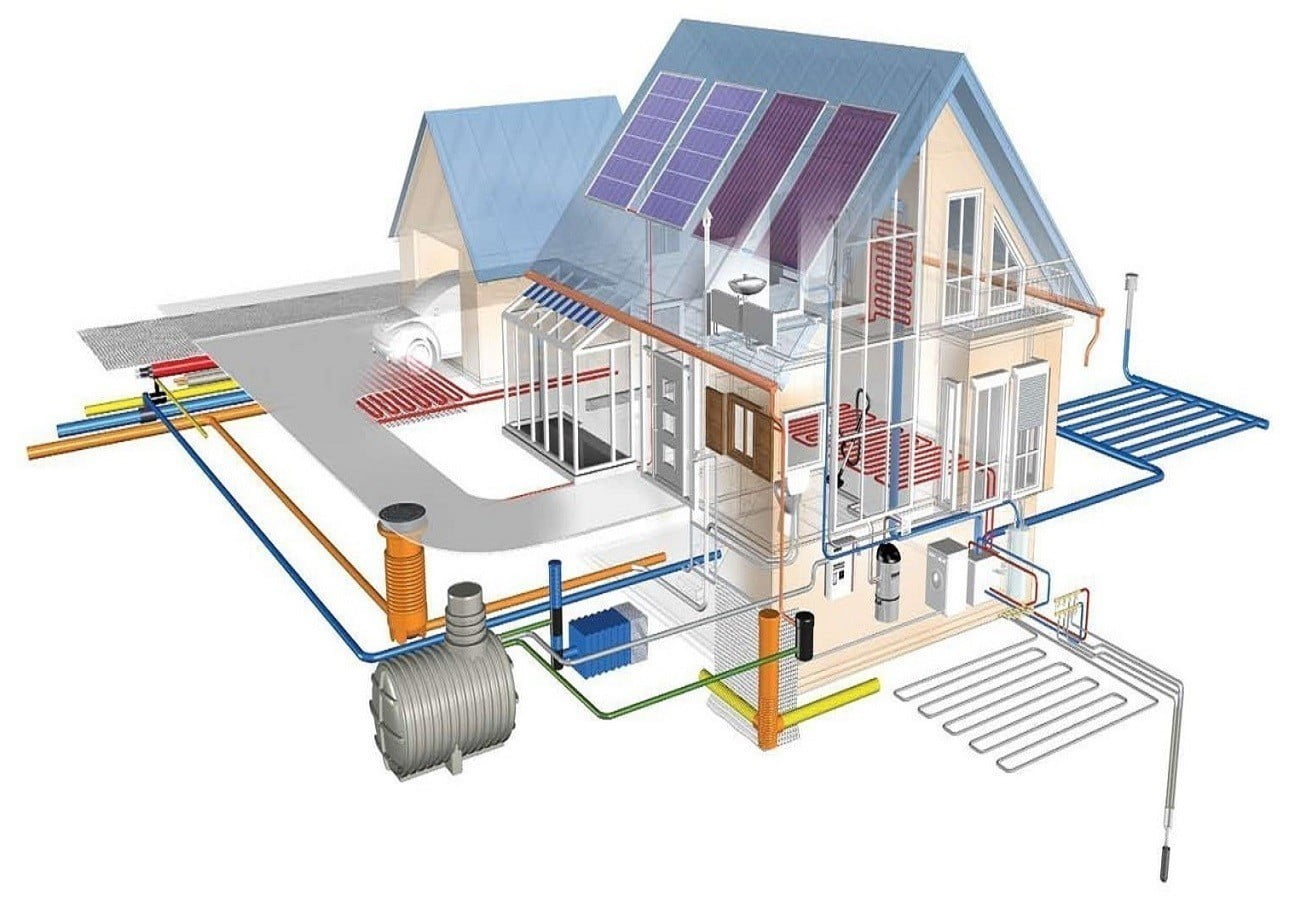

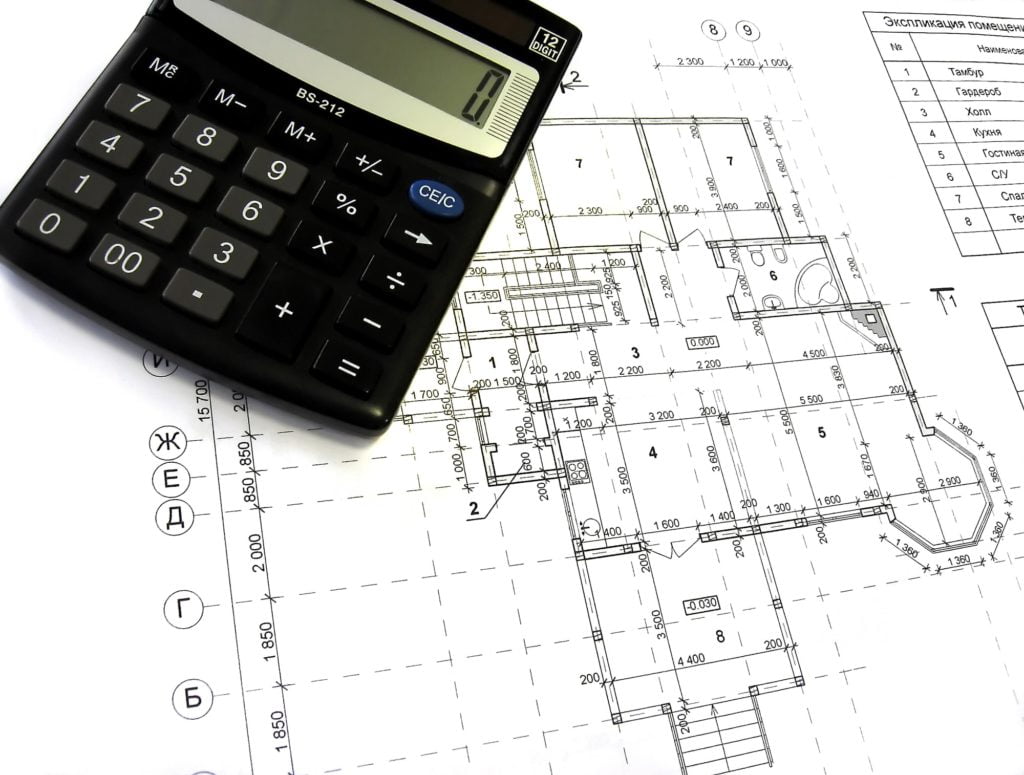

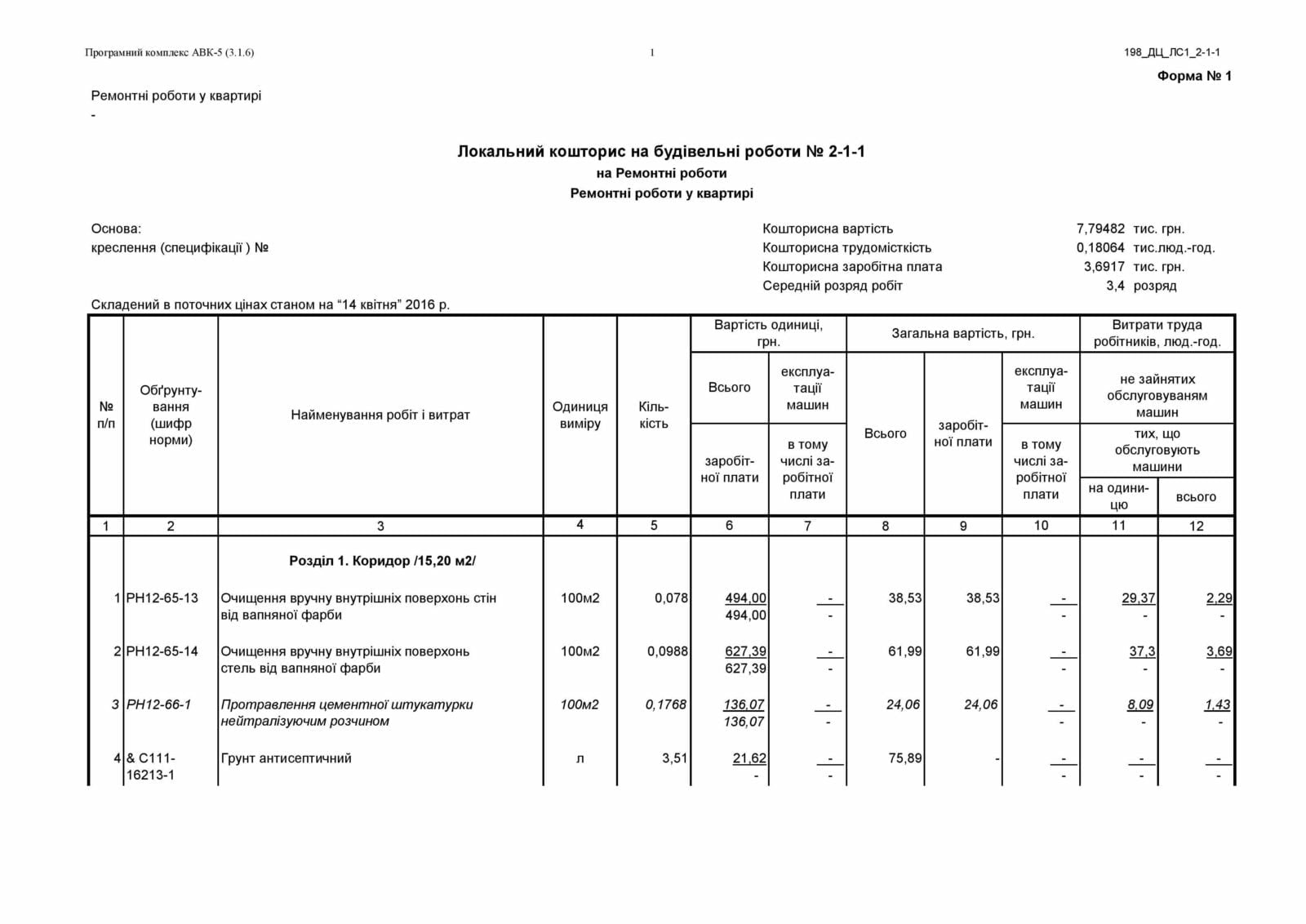

При плануванні будь-яких будівельних робіт настійно рекомендується складання кошторису. Цей фінансовий документ складається на підставі робочого проекту та належить до первинної документації. Він регламентує будь-який рух матеріальних засобів під час будівництва. Написанням кошторисів займається кваліфікований інженер-кошторисник. Замовити кошторис на будівництво можна в профільній організації, яка надає такі послуги. Виготовити такий документ може підрядник. Готується кошторис згідно з чинним законодавством, нормативними актами й кошторисними нормами, з урахуванням поточних ринкових розцінок на роботи й матеріали, а також коефіцієнтів їх зміни.

5 причин чому потрібен кошторис

У цьому фінансовому документі вказано розрахунки матеріальних витрат на виконання конкретного проекту, а також кількість матеріалів і трудових ресурсів, планованих до використання.

Це обумовлює причини, за якими купити або замовити кошторис варто.

- Завдяки ретельно складеному кошторису ще до початку будівельних робіт ви отримуєте повне уявлення про майбутні витрати. Це допоможе підготуватися й не розтягувати виконання проекту на довгі роки через нестачу фінансів.

- Кошторис дозволяє передбачити більшість ситуацій, що можуть...

![[:ua]Кошторис на ремонт даху[:ru]Смета на ремонт крыши[:]](https://ukrsmeta.ua/wp-content/uploads/2016/10/smeta-na-remont-kryshi.jpg)

![[:ua]Складання кошторисів на пожежну сигналізацію[:ru]Составление смет на пожарную сигнализацию[:]](https://ukrsmeta.ua/wp-content/uploads/2016/09/smety-na-pozharnuyu-signalizatsiyu.jpg)